Higher capital requirements for derivatives trading will create economic incentives for banks and other market participants to move their foreign exchange positions into clearinghouses.

Most participants in the global foreign exchange markets have been reluctant to adopt central clearing, but that may soon change due to the impact of new capital and margin requirements.

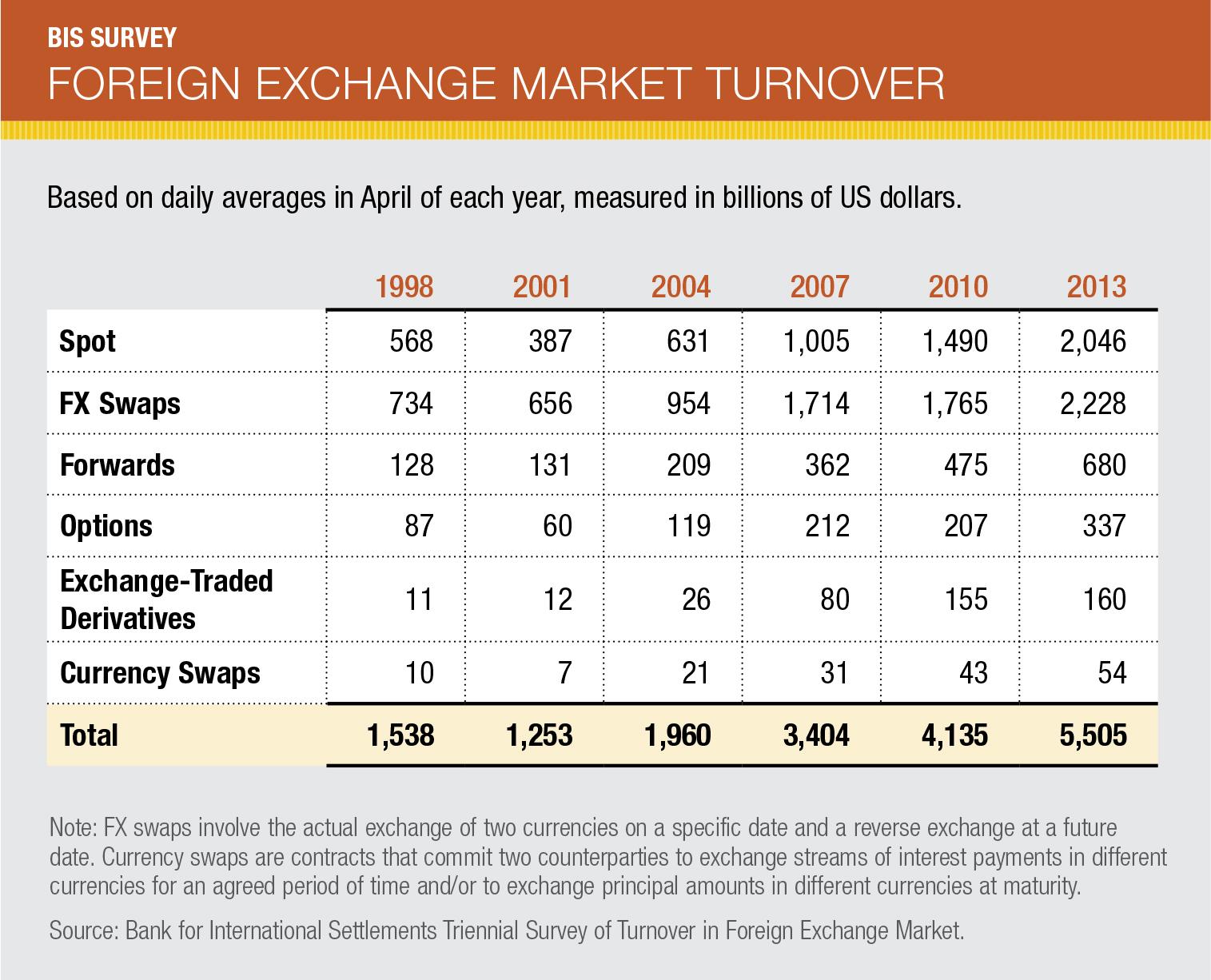

Central clearing is already a core feature of the markets for FX futures offered by exchanges such as CME Group, but those markets make up only a tiny fraction of the $5 trillion in foreign exchange traded per day. The vast majority of trading in the global FX markets is done over-the-counter, and until recently there was little appetite for clearing.

One major reason why many market participants expect this to change is the implementation of a new set of capital standards on the banking industry. This will make it more expensive for banks to trade derivatives, creating an economic incentive to send some portion of their trades to clearinghouses. Another key factor is the implementation of margin requirements on all uncleared derivatives. This will affect a much wider range of market participants, and is expected to encourage greater use of clearing as it comes into effect over the next several years.

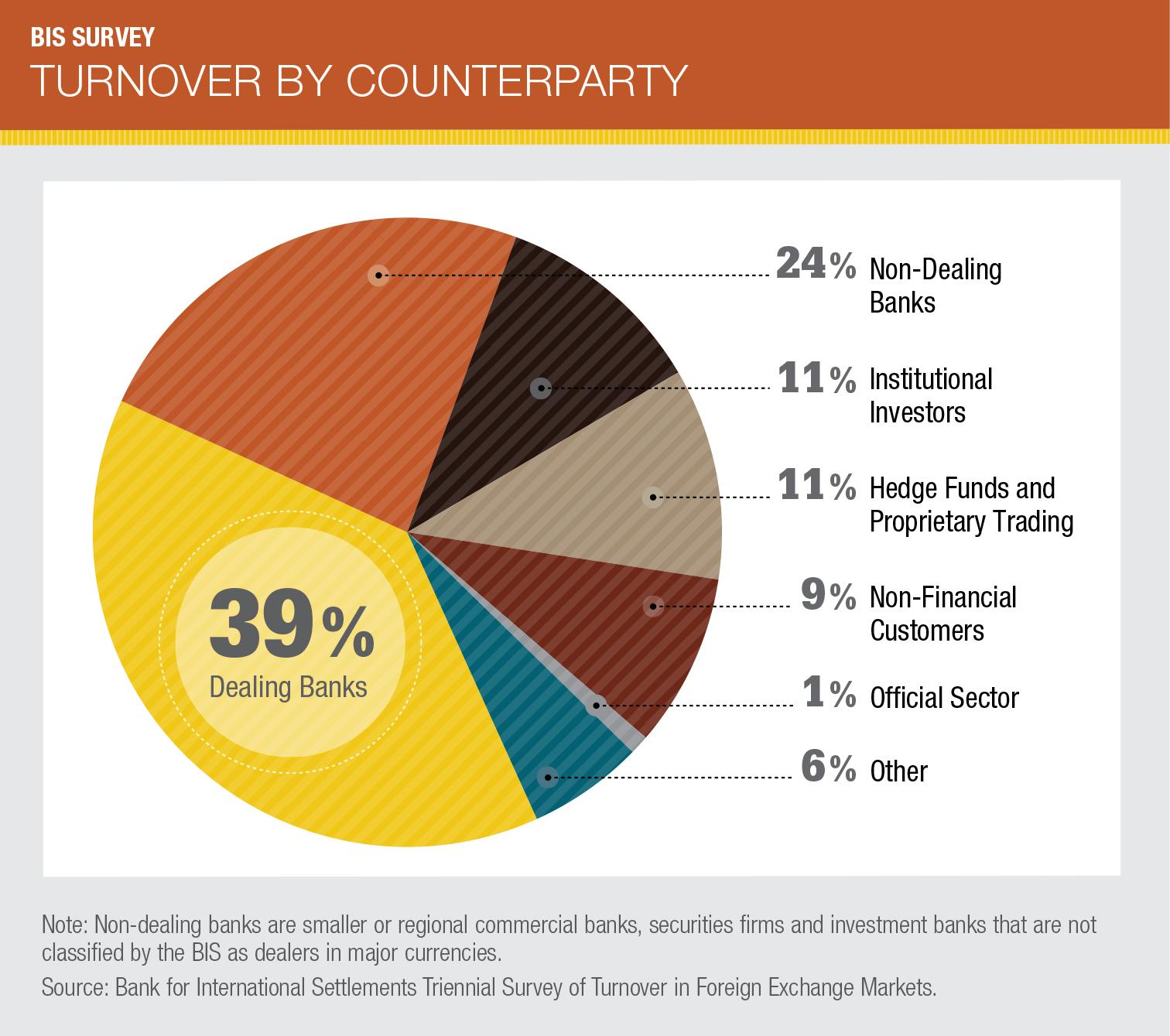

Other trends in the FX markets also may encourage greater adoption of clearing. More and more of the liquidity in the FX markets is coming from trading firms that specialize in automated market making. These firms tend to favor clearing as a way to reduce counterparty risk and expand access to the market. In addition, electronic trading is becoming more common, paving the way for changes in market structure that support greater use of clearing.

The path forward will be quite different, however, from the trends seen in other asset classes. In the interest rate and credit default swap markets, clearing is now mandatory for most market participants in the U.S., and according to the latest official statistics, more than 70% of trading in these two sets of products now goes to clearing. Japan has similar requirements, and Europe will begin implementing mandatory clearing for interest rate swaps later this year.

In contrast, regulators have not adopted a mandatory clearing requirement for foreign exchange derivatives. U.S. and European regulators were considering such an approach in 2014, but ultimately decided to put the idea on hold. Instead the main driver to bring FX contracts to central clearing is likely to be Basel III capital requirements, and in particular the requirements to pay and collect margin on uncleared derivatives and set aside more capital for derivatives positions. These requirements will come into effect in phases over the next several years and banks and other financial institutions are scrambling to reduce their derivatives exposures.

The impact will fall more heavily on some types of FX derivatives than others. For example, the margin requirements for uncleared derivatives will require banks and other financial institutions to pay and receive both initial and variation margin on their FX options and non-deliverable forwards. For FX swaps and deliverable forwards, only variation margin will be required. This makes it difficult to calculate the ultimate impact on the FX markets, but there is no question that it will soon become a lot more expensive to trade derivatives if they remain outside of clearing.

“We calculate that the cost of an uncleared OTC derivatives transaction will be two or three times more than the cost of centrally clearing that transaction," commented Gavin Wells, the head of LCH.Clearnet's ForexClear services. "By September 2020, anyone trading OTC options or NDFs will have to pay initial margin and variation margin every day. On forwards they will have to pay VM every day. It’s so much easier to do that with a single CCP rather than bilaterally with every counterparty you trade with."

From NDFs to Options

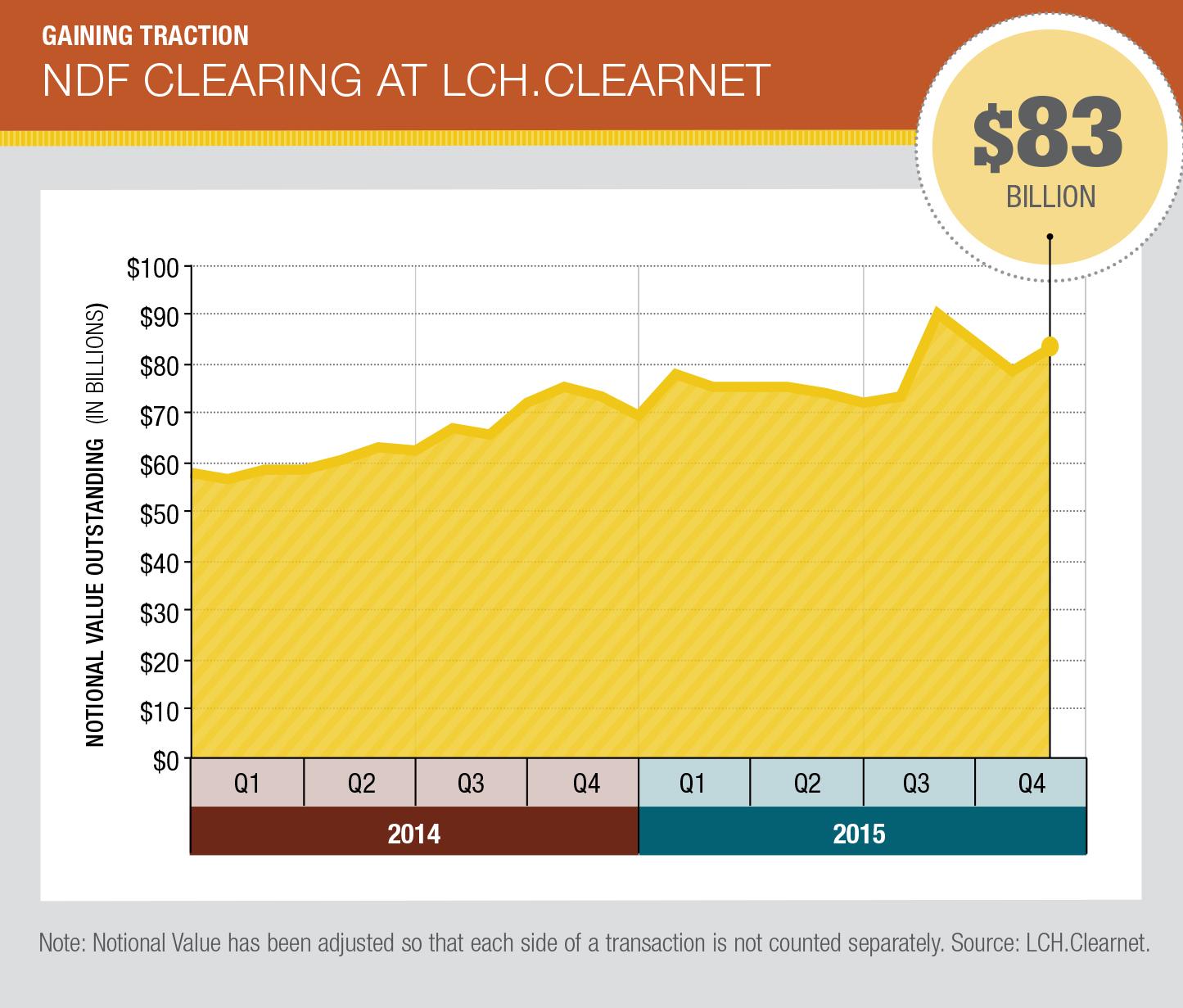

LCH.Clearnet is positioned to be the one of the first beneficiaries. The clearinghouse's ForexClear service has offered clearing for non-deliverable forwards since 2012. Although its share of the overall NDF market is very small, the flow of trades into the clearinghouse is slowly rising. In August, the most active month so far, 5,368 trades worth $54.1 billion in notional value were submitted for clearing. That compares to 3,298 trades and $34.9 billion in August 2014. Since January 2014, the notional value of the outstanding positions at the clearinghouse has risen from $57.9 billion to $82.9 billion as of the end of November.

The service is primarily aimed at clearing trades between dealers, but LCH.Clearnet is trying to attract client trades as well. In May, ForexClear expanded its service to include European clients and signed up four firms, including HSBC, Societe Generale and Standard Chartered, to offer NDF clearing to their clients. As Societe Generale explained at the time, the goal was to give give buy-side firms time to prepare for clearing NDFs well before the margin requirements on uncleared derivatives come into effect.

LCH.Clearnet is also building operational connections with swap execution facilities, the trading platforms established to meet the swap trading requirements of Dodd-Frank. In August, LCH.Clearnet cleared a client trade that had been executed on SwapEx, the SEF operated by State Street, with Societe Generale acting as the clearing firm. LCH.Clearnet also has established connectivity with the SEF operated by Thomson Reuters, which concentrates on bank-to-client trading in NDFs.

"Impending regulations on capital requirements will increase the relative costs of settling non-centrally cleared derivatives trades bilaterally," Jodi Burns, global head of regulation and post-trade at Thomson Reuters, said when the two companies announced the link-up. "We recognize that this cost, along with the benefits of removing counterparty credit risk, will naturally drive demand for FX NDF clearing."

LCH.Clearnet's next move is to extend clearing to foreign exchange options. In August, the clearinghouse announced that it was working with CLS, the major FX settlement system, to provide physical settlement for cleared FX products, starting with FX options in six major currencies.

Clearing FX options presents some difficult challenges, however. Unlike NDFs, which are cash-settled, the options have physical delivery. That means that in a default scenario, the clearinghouse needs to have the ability to actually deliver the underlying currency. That is the main reason for the partnership with CLS, which mitigates settlement risk in the FX market by arranging for simultaneous payments on both sides of an FX trade on a real-time basis. CLS is owned by the leading banks in the FX market and settles on average $8.4 trillion per day in spot, forwards, swaps and options.

The launch date for clearing FX options has not been set yet, and it is not clear how much demand the service will actually have. Some market participants are skeptical, saying the cost benefits of clearing have been overstated. But Simon Manwaring, global head of FX options at RBS, said that while clearing of NDFs and options has been slow to materialize, the impact of margin requirements will make it inevitable.

"The margin for uncleared derivatives will be penal," said Manwaring. "It will make economic sense for at least the top 10 banks by options volume to clear."

A hybrid model for exchanges

While LCH.Clearnet has focused on clearing, Deutsche Boerse is targeting the trading side of the business. The German markets operator reached an agreement in July to buy 360T, one of the largest multilateral trading platforms in the FX markets. 360T supports trading in spot, forward, swaps and options and focuses on serving multinational corporations, asset managers, commercial banks and other customers.

According to a report published by consulting firm Aite in May, trading on 360T averaged $72 billion in notional value per day in February, which was equivalent to about 6% of the volume executed on multilateral platforms. In comparison, FX Connect, a platform operated by State Street, had about 8% of this segment of the market, CME Group had about 9%, and Bloomberg had about 11%.

In effect, the deal gives Deutsche Boerse a way to integrate its clearing and other post-trade services with one of the leading electronic platforms for trading foreign exchange products. Past efforts by exchanges to capture a share of the FX markets have sought to encourage market participants to adopt exchange-style trading, with a central limit order book similar to what exists in the equities and futures markets. In contrast, Deutsche Boerse's current strategy is based on a hybrid model, where trades continue to be executed via request-for-quote from dealers and other OTC trading protocols. Deutsche Boerse has had success with this model in other asset classes, notably equity futures and options, and its clearinghouse, Eurex Clearing, offers several ways for customers to bring contracts executed away from the exchange into its clearinghouse.

Alfred Schorno, one of the top executives at 360T, explained that his firm expects the market to evolve towards this hybrid approach that combines the flexibility of OTC trading with a pipeline into central clearing. “We believe strongly that the market will go exchange-like. That means keeping OTC flexibility you do your bespoke amounts, dates but then you put the trade through clearing. That was part of the deal rationale for Deutsche Boerse and also the 360T management.”

Three credit models

Schorno added that the hybrid approach also extends to supporting several different approaches for managing counterparty risk. 360T will have three credit models: the traditional direct model based on bilateral relationships, a prime brokerage model, and a clearing model.

He expects that corporate customers will continue with the direct model. "These clients are unlikely to go to clearing, margining and futures. Why? Because they need their transactions to have specific dates, otherwise they have balance sheet and profit implications," he explained. "They also don’t want to do margining. They see that as bringing additional charges."

The bank-to-bank business, however, will be different, particularly with respect to NDFs, options and FX swaps. "Here the balance sheet implications will drive the market to adopt clearing sooner rather than later," he said.

Schorno also pointed to another factor that may drive market participants to adopt clearing. He noted that prime brokerage charges have gone up considerably since the Swiss National Bank removed its currency peg in January, a move that caused a massive disruption in the FX markets. “I believe that the SNB decision on January 15 created more focus on the true price of credit risk," he said. "PB charges have gone up considerably since and some of the PBs are reconsidering their business models or already have pulled back from the market. From our point of view, it will only be another year or so before the economic reason to use clearing outweighs the regulatory one. If you can save twice the PB fee by clearing, then it’s a different value proposition than before January 15."

Mark Suter, chairman and founder of options trading platform Digital Vega, also expects a gradual move toward clearing. The company specializes in electronic trading of FX options, drawing on liquidity provided by 13 banks, and has a small but growing share of bank-to-bank trading of options.

“The move towards clearing has so far been quite slow in FX, but our view is that it is ultimately inevitable," Suter said. "As with all market structure changes, this will take time, but people will analyze clearing from a commercial perspective. The large institutions will move as a herd once it’s been proven that it works efficiently and costs remain realistic. Others will then follow,” he said.

Suter added that while the focus will initially be on relatively low volume products such as NDFs, the far bigger spot and swap markets may get dragged into clearing as well. “A very large proportion of the products traded in FX are simple and lend themselves to clearing. Once options move through clearing, I’d imagine that players will also want their delta hedges to pass through the clearer. So the move will start to feed on itself. That will reduce margin requirement, by concentrating the net exposures,” he explained.

Back to the Futures?

CME Group is another potential beneficiary of the trend towards clearing, but it is taking a different approach. Although it began offering clearing for NDFs in 2012, the service has failed to gain any traction, and the group is now more focused on promoting its listed futures and options products. Those markets have long served as an alternative liquidity pool for firms that trade FX in the OTC markets, and CME officials are emphasizing the capital efficiencies that listed derivatives can offer in the post-Basel III world as well as the operational efficiencies that come from highly automated electronic trading.

FX trading on CME and other futures exchanges has risen dramatically over the past decade, but it is still only a fraction of the overall market for FX derivatives. According to the most recent survey conducted by the Bank for International Settlements, the total value of all FX futures and options trading on derivatives exchanges was $160 billion in April 2013, double the amount traded in 2007, but only 15% of the total value of forwards, options and currency swaps traded OTC. Add in the value of trading in spot trades and foreign exchange swaps, and the futures industry's share of the global FX market falls to less than 1%.

Even so, CME has observed a steady rise in the number of large open interest holders, defined as customers holding open positions in FX futures greater than $50 million. The exchange views this trend as an indication that new customers are coming in from the OTC markets. "We had an all time record of 1,007 in August, which was double what it was in 2009,” said Will Patrick, executive director of FX products for CME in London.

Patrick believes credit costs are at least part of the reason. “I think it’s fair to say that [prime brokers] have reassessed their business, and I think we’ve picked up customers as a result of that. And looking at our products, people have started to see advantages, such as true netting. When credit was cheaper, that wasn’t really a factor, but as people start to prepare for the various tiers of Basel III, they are looking at things like the leverage ratio and its impacts. While PBs can net within a single client’s portfolio, they can’t net across counterparties. That’s now a challenge for the OTC market,” Patrick added.

Patrick’s colleague Craig LeVeille, who is based in Chicago, offered an additional explanation the rise of non-bank market makers. "Obviously the banks are still the primary liquidity providers but there is a shift taking place towards non-bank liquidity providers," he explained. "To facilitate that [trend], you need an environment that creates broader credit intermediation. A clearing environment enables more of that to take place.”

One such non-bank market maker is Virtu Financial. The New York-based firm actively makes markets on a large number of FX trading venues, including EBS, Reuters, Hotspot, Currenex, FXall and CME, and provides liquidity to a growing number of dealer-to-client platforms.

John Shay, the firm's senior vice president for transaction and technology services, is convinced that the capital efficiencies of clearing will drive changes in market structure. He explained that in the current environment, market makers like Virtu are providing liquidity across a large number of trading venues and trading relationships. That means the firm has to manage the cost of having margin deposits and account balances at a large number of individual prime brokers around the world. That's in addition to the funds they hold at clearing firms to cover the margin requirements for their trades on futures exchanges and any other cleared trades.

"It doesn’t make sense for large players like us to keep margin balances in two places,” he said. “This is why we can see a structural change coming because of the efficiencies that clearing gives all participants,” he said. "Trading has to move to a clearinghouse. Even spot will definitely go at some point. Economically it makes sense. Market participants will force a more efficient way of trading."