More than a dozen exchanges battled for market share amid declining levels of trading activity

Trading volume on U.S. options exchanges totalled 4.14 billion contracts in 2015, a 2.9% decrease from 2014. On average, traders exchanged 16.4 million contracts per day in 2015, compared to 16.9 million per day in 2014.

Since 2012, market participants have pinned stagnant options volume on the lack of volatility, which they say has eliminated trading opportunities. That reasoning was not as tenable in 2015. Although trading activity rose when volatility spiked during certain periods of the year, those periods were quickly followed by anemic trading activity.

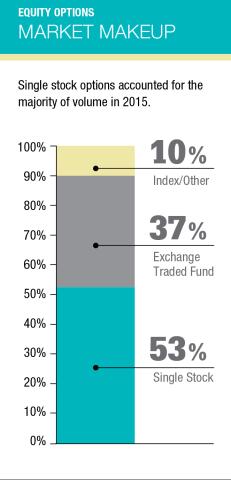

Growth in ETF and index products

While overall volume fell in 2015, there was encouraging growth in pockets of the market, particularly in certain broad-market ETF and index products. Volume in S&P 500 options traded on CBOE jumped 5.7%, the third straight year of volume growth in this product. Investors also gravitated toward the SPDR S&P 500 ETF options, with volume increasing 7.7% in 2015.

Amid the slump in trading, the battle for market share intensified among exchange operators. BATS Global Markets' BATS BZX Options and MIAX Options, were the biggest winners of 2015. BATS increased its market share to 9.6% from 4.8% in 2014. MIAX increased its market share to 6.1% from 3.2% in 2014. NYSE AMEX and CBOE each lost 2.8% in market share.

CBOE Holdings continued to hold the largest market share with 27.1% across its two exchanges in 2015. That was down slightly from 29.9% in 2014. Nasdaq ranked second, with 22.7% market share across the three exchanges it operates. The two NYSE options exchanges operated by Intercontinental Exchange ranked third, with 22.7% combined market share in 2015, down from 24.3% in 2015.

More trading venues

The proliferation of options exchanges shows no signs of slowing down. In November, BATS launched a second options exchange, BATS EDGX, bringing the total number of exchanges in the U.S. options marketplace to 13. The new exchange operates with a customer priority/pro-rata allocation model to capture the pro-rata segment of the market it could not previously support. At least two more are slated to open this year. ISE launched Mercury, an options exchange with customer priority/pro-rata allocation in February, while MIAX plans to launch a new customer priority/price-time allocation exchange later in the year. If MIAX launches its second exchange, there will be 15 options exchanges in the U.S.

Changes in investors’ overall experience trading listed options last year were mixed. Average bid/ask spreads, a popular indicator of market quality, declined to 0.33 in 2015 from 0.36 the prior year. However, the average bid/ask size at the top of the book dropped to 195 contracts from 214 contracts in 2014, indicating market makers reduced risk exposures in the volatile trading environment. The average trade size grew to 17.3 contracts in 2015 from 16.7 contracts in 2014.