Two Chinese state-owned oil companies have become major players in the physical market for Middle Eastern crude oil. Platt's analyst Daniel Colover describes this trend and its implications for the Dubai and Oman price benchmarks.

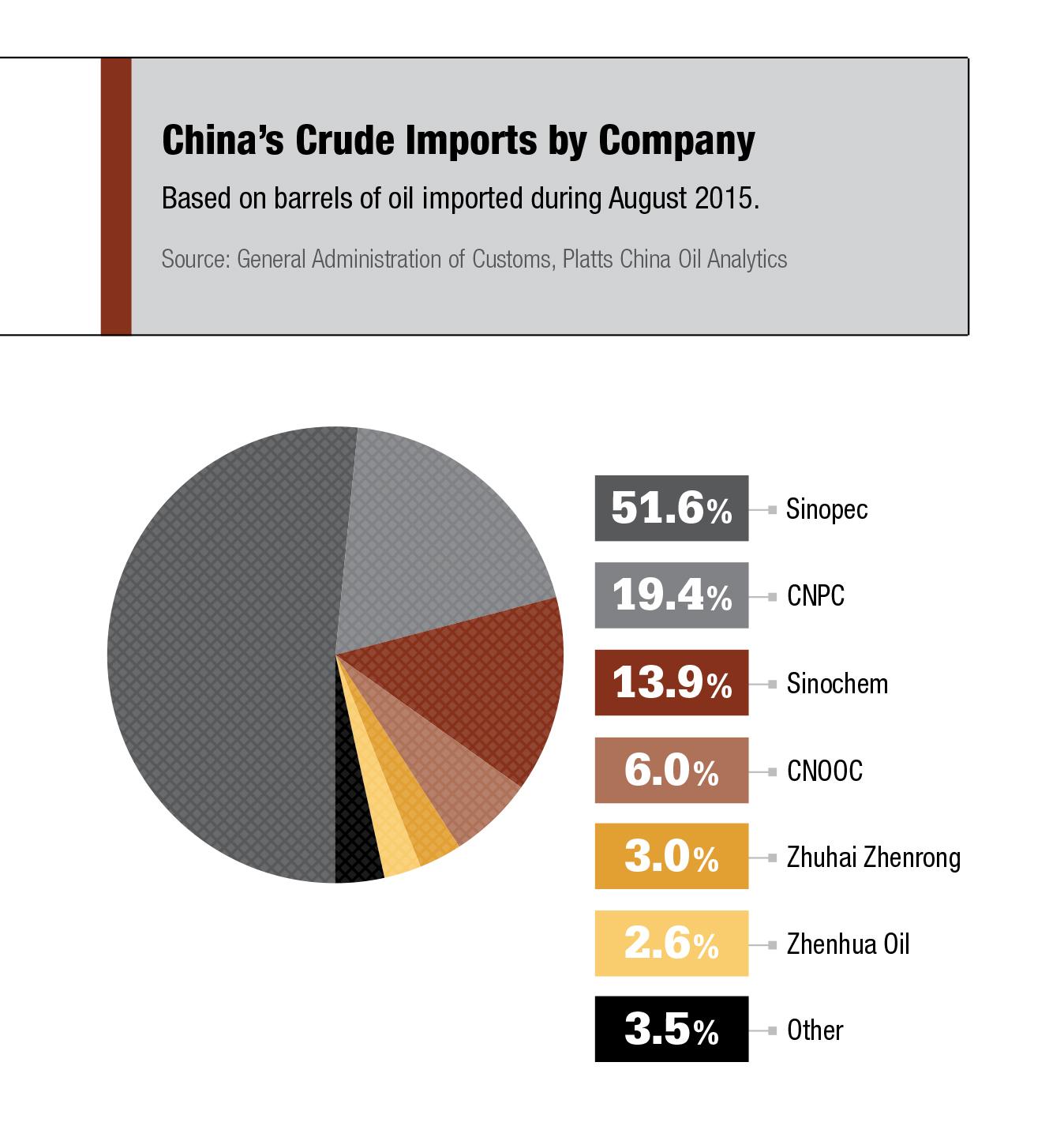

China is increasingly advancing its position in the global energy arena, not only as one of the largest consumers and producers of oil and other energy commodities, but also at the corporate level. Several Chinese companies now rank among the largest energy companies in the world, and two companies in particular, CNPC and Sinopec, are major players in the physical markets for crude oil.

Given the growing size and impact of China’s energy giants on the world stage, it isn’t difficult to understand China’s appetite to exercise its influence in the broader realm of open market pricing. Enter China’s plan for its first crude oil futures contract. The timing of the launch is uncertain, but the goal is clear. The Chinese government’s vision is to have its commodity markets priced off its own exchanges and its own price references. An exchange has been established in Shanghai's free-trade zone under the purview of the Shanghai Futures Exchange, and international companies are being encouraged to help develop the contract into a benchmark for China's oil imports.

Only time will tell if this new contract will succeed, but one key factor is already present. Chinese oil companies have been ramping up their presence on global energy markets in recent years, particularly in the spot crude oil markets of the Middle East. Some in the markets see this as a precursor to participation in the Shanghai crude oil futures contract, in the sense that these companies can source large volumes of crude as and when needed from the open markets of the Persian Gulf. Those supplies of oil could underpin the new futures contract, which will be physically deliverable using mostly Middle Eastern grades of oil.

If that is the case, the future of China’s futures contract will depend at least in part on the continued openness and efficiency of trading in Middle Eastern crude. The Chinese participation in Middle Eastern crude markets also demonstrates the importance of benchmarks such as the Platts Dubai and Oman assessments in the price discovery process for Middle Eastern crude oil.

Evolution of a benchmark

Traditionally, it was the Middle Eastern producers of Saudi Arabia, Iran, Kuwait and Iraq that used the Platts Dubai and Oman crude oil price assessments as the benchmarks for their official selling prices to Asian customers, with about 15 million barrels per day of oil pricing off those assessments, according to various estimates. Gradually, producers in the wider Asia Pacific region also looked to the Platts Dubai and Oman crude oil assessments as benchmarks. The past 18 months have seen a series of record highs in the oil trading volumes captured within the Platts Dubai price assessment process, with Chinese oil companies playing a central role in this trend.

To understand what this trend represents, one must first examine what the Platts Dubai and Oman assessments reflect and the methodology that underpins them. The assessments reflect a market on close value at 16:30 Singapore time and reflect prices for physical crude oil traded in partials, i.e., lot sizes of 25,000 barrels. This means that each cargo of 500,000 barrels of Middle Eastern sour crude is formed of 20 partials of 25,000 barrels which are bilaterally traded. For the Dubai assessment, there is an alternative delivery mechanism that gives sellers the option of nominating a cargo of like-kind crudes—Abu Dhabi’s Upper Zakum or Oman crude oil—to their counterparty upon the convergence of 20 partials of Dubai crude. The alternative delivery mechanism, introduced about a decade ago, raised the amount of deliverable crude to the benchmark to about 1.6 million barrels a day.

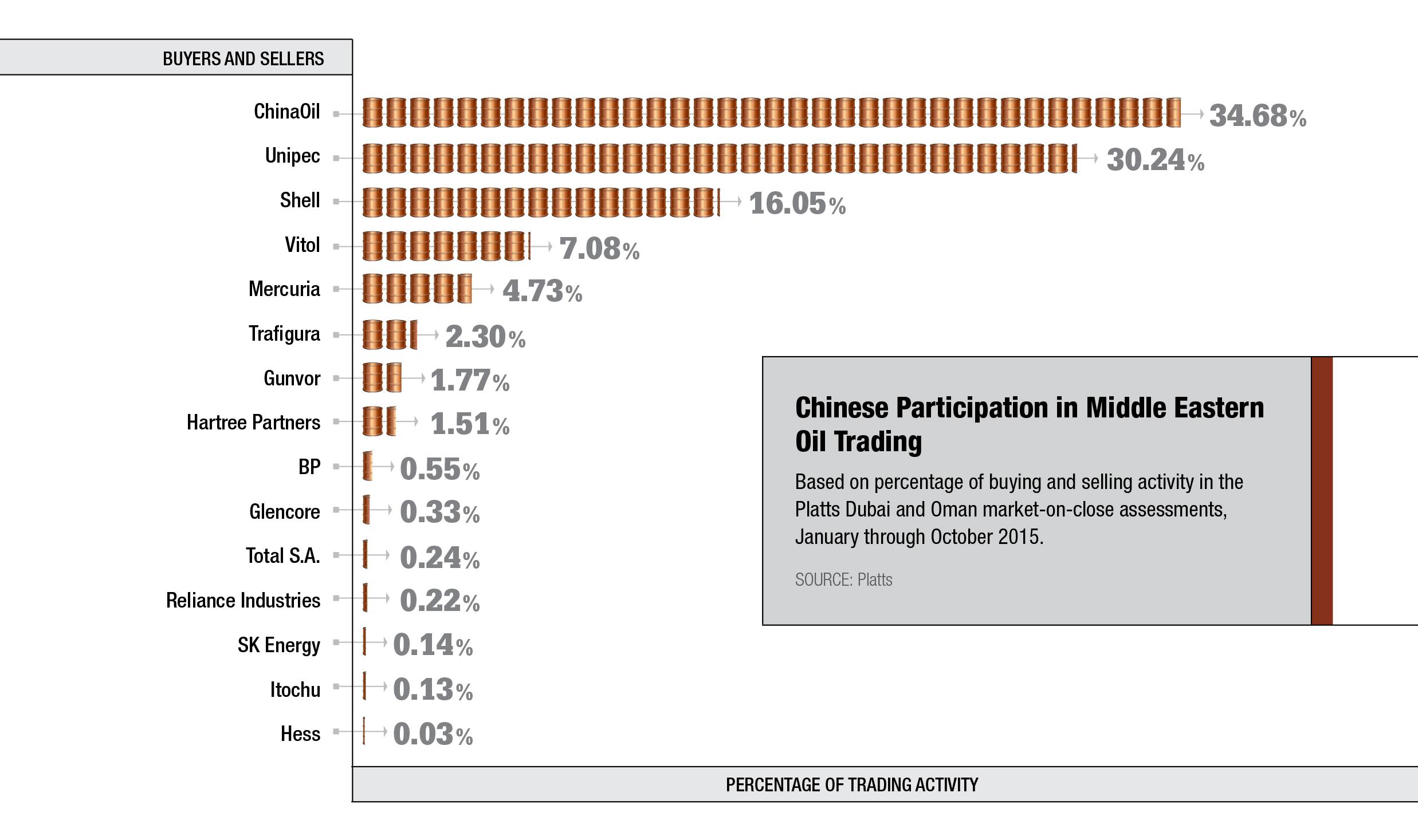

Unique to the Platts Dubai and Oman price assessment process is the fact that it reveals, through real-time publishing, the name of all companies participating and identifies each bid, offer and transaction by company of origin. This makes it the most transparent oil price discovery process worldwide. It also provides a window into the increasing participation by Chinese energy companies and two in particular: Chinaoil and Unipec, the trading arms of CNPC and Sinopec respectively.

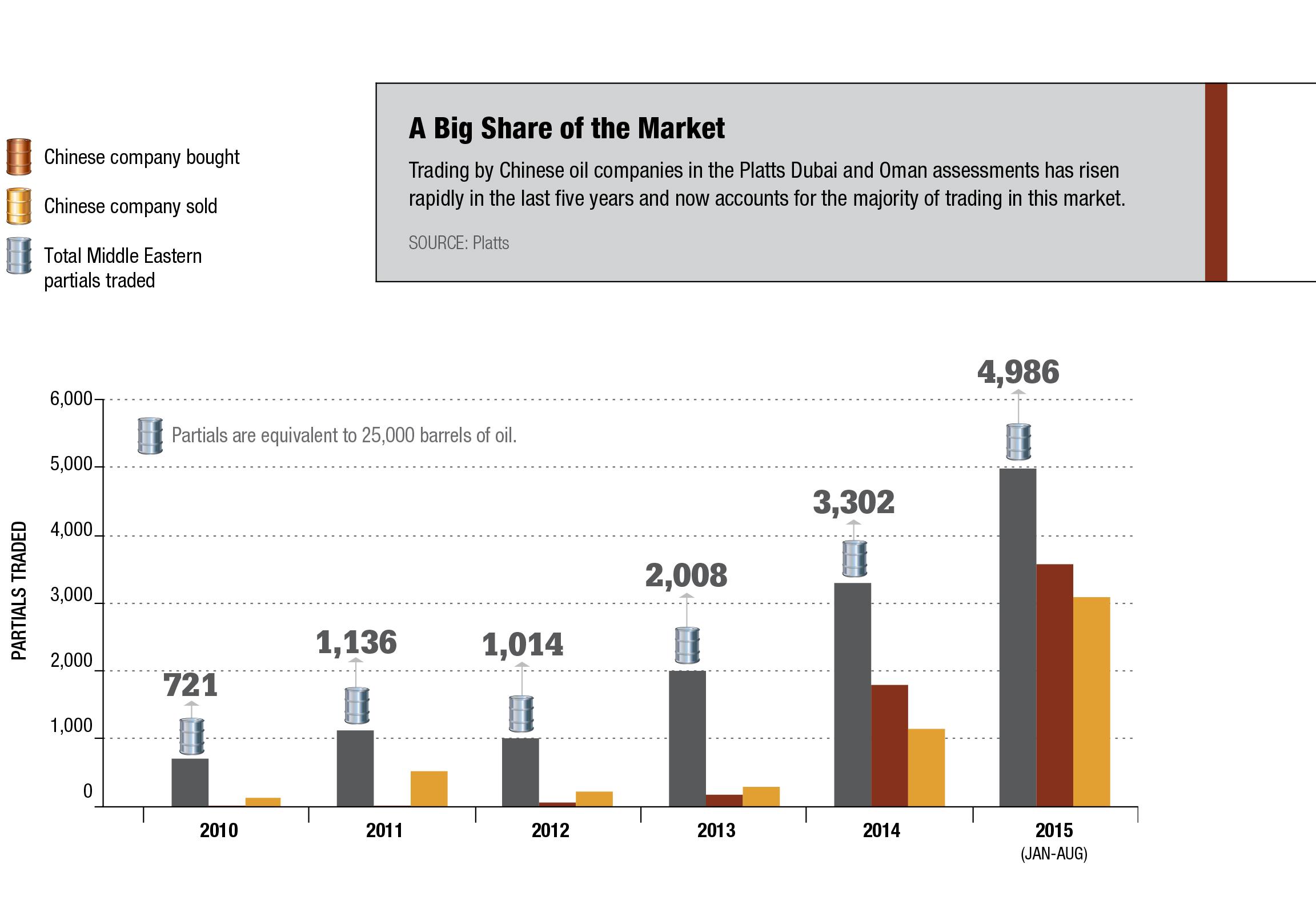

Take a look at the last five years. In 2010, these two companies purchased two partials and sold 129, a small fraction of the total amount of 721 partials that changed hands. By 2012, the total amount of partials trading had risen to 1,014, with the two Chinese companies buyers of 63 and sellers of 222. In 2014, the total had risen to 3,302, with the Chinese companies buyers of 1,800 and sellers of 1,160.

This trend of rising participation by the two Chinese companies has been even more pronounced in 2015. Of the 5,261 partials traded from January to the end of November, the two Chinese companies purchased 3,584 and sold 3,187. In many cases, they were on either side of the transaction.

As part of its ongoing evolution of benchmarks, Platts in November confirmed that it would expand the alternative delivery mechanism for the Platts Dubai and Platts Oman price assessment processes to include additional oils. From January 2016, destination-free cargoes of Abu Dhabi’s Murban and Qatar’s Al-Shaheen crude oils will become deliverable against the Platts Dubai benchmark, joining Upper Zakum, Oman and, of course, Dubai crude itself. Using conservative estimates, these new crudes will add around 600,000 b/d of deliverable crude into the Dubai benchmark, bringing deliverable crude up to an estimated 2.4 million b/d – or three times more oil than the combined supply of the four grades of crude that form Dated Brent.

This decision reflects the growth of trade in Middle Eastern crude and the impact of China’s growing presence in the markets. The Dubai benchmark has seen record volumes of physical trade reported through the MOC process three times in the past 18 months. In the most recent record month of trade, August 2015, Chinaoil purchased 72 cargoes of 78 cargoes delivered against the benchmark, taking total physical deliveries close to their maximum levels.

Building a new market in Shanghai

China's new crude oil futures contract has been in development for several years and appears to be moving slowly to an official launch. Draft plans have been circulated with details on the contract specifications and the authorities are reviewing the rules for trading on the new exchange, the Shanghai International Energy Exchange. The exchange was established specifically to support the new contract.

The contract is expected to reflect the price of medium, heavy sour crude delivered into bonded storage in China. As drafted, there will be seven crude grades in the contract, of which six come from the Middle East and one, Shengli, from within China itself. This may change, however. The authorities are taking a fresh look at the deliverable grades while they step up efforts to ensure plentiful storage for participants and avoid too much dependence on Middle Eastern crude, sources close to developments told Platts. One source from the exchange said the INE has started considering the possible inclusion of other medium sour crude from Russia, Latin America and West Africa. These would have to be popular grades in China that can be freely traded without destination restrictions.

Per the draft plans, the contract will have a minimum size of 100 barrels per lot and will be priced in yuan. In contrast, international oil trading is typically priced in U.S. dollars, and the contract size for the two main international futures contracts are based on 1,000 barrels of oil.

Some market participants have noted that the contract size and currency denomination may deter participation from international companies. On the other hand, several factors favor its popularity inside China. As noted above, Chinese companies have become far more active in the physical trading of Middle Eastern crude oil, and it would not be surprising if this activity extended to the new contract. For another, look to the crude import quotas recently given to a number of Chinese teapot refiners, so described for their small size.

These privately owned refineries previously did not have access to imported oil and relied on fuel oil and bitumen blend, along with some domestically produced crude supplied to them by the Chinese state owned oil companies, as a feedstock for their refining. In 2015, however, more than 600,000 b/d of crude import quotas were granted to seven teapot refiners. If they source oil through the SHFE futures contract, this will provide some liquidity to get the contract started. However, some argue that in the short term this may only increase spot trading activity by the state-owned enterprises as they immediately procure and supply the new crude allowances to the teapot refiners.

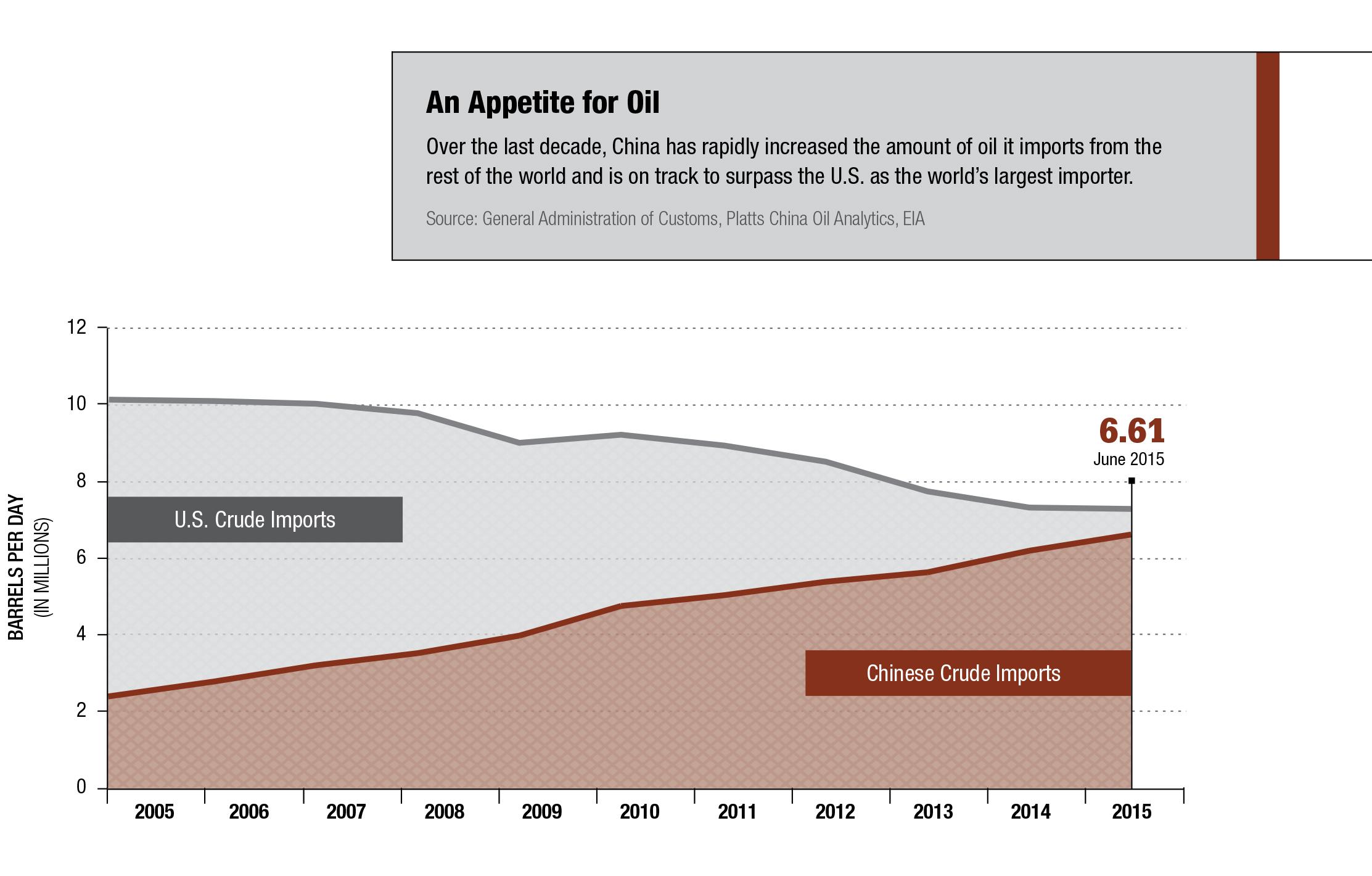

As for oil imports, it is interesting that recent slowing of China’s gross domestic product growth and the rout in its stock market have not curtailed its crude oil imports, which have continued to rise, especially with the country’s priority on building strategic oil reserves. China’s crude oil imports hit a record 7.4 million b/d in April, which at the time placed the country as the single largest importer of crude oil globally, surpassing the 7.21 million b/d of crude imported by the U.S. Putting this in historical context, in 2014, China imported an average of 6.19 million b/d; in 2013, an average of 5.64 million b/d; and back in 2005, the average was as low as 2.39 million b/d.

China is clearly making its presence more fully felt on the international energy stage. Although the new Shanghai futures contract faces challenges to its adoption as an international benchmark, interest from China’s oil companies and other domestic market participants will likely make it an important reference for the world energy markets.