In this special feature, the editors of MarketVoice have picked out nine people who we expect will have an outsize influence on our industry in 2016. Some embody technology or business trends that are reshaping business models and market structure. Some have risen to positions of influence in some of the most important institutions in our markets. And some have a key role in setting policy on important regulatory issues.

Carsten Kengeter

Project Accelerate

CARSTEN KENGETER WANTS to step on the gas. Since joining Deutsche Boerse in June, the new CEO has set in motion a plan to accelerate growth throughout the organization. In meetings with shareholders, he has promised to increase profits by 10% to 15% per year through a combination of acquisitions, internal growth opportunities, and cost reduction. Key to his strategy is an effort to change the organization’s culture. Kengeter, who joined the exchange group after nearly two decades in capital markets at UBS and Goldman Sachs, wants to foster a more entrepreneurial and client-centric approach to the business, increase the speed of decision making, make individuals more accountable for their performance, and develop a new generation of talent. He also has made three transactions to open up new paths to growth, paying 560 million euros to acquire full control over Stoxx, the index provider, paying 725 million euros to buy 360T as an entry point into foreign exchange markets, and forming a joint venture with two Chinese exchanges as a gateway for investing in Chinese products. Kengeter speaks English, French and Mandarin as well as his native German.

Although he is new to the exchange-traded derivatives world, his years of experience in running trading businesses, including several years as the CEO of the UBS investment bank, give him high-level contacts throughout the markets and a deep understanding of what clients want. Looking ahead, Kengeter expects Eurex to be the division within that will generate the biggest revenue increase, particularly as more OTC derivatives come into clearing and the exchange continues to introduce new products. He also has high hopes for the European Energy Exchange, which has been growing very rapidly in recent years, and for the group’s Asia-related ventures. Compared to its global peers such as CME Group and Intercontinental Exchange, Deutsche Boerse has not grown as rapidly in terms of derivative trading volumes or market capitalization, but Kengeter is clearly determined to close the gap.

Loh Boon Chye

Customer Focus

FOR YEARS THE Singapore Exchange has thrived by serving as a regional financial center, offering a pan-Asian suite of derivatives on commodities and financial market indices. That business strategy paid huge dividends in 2015. Total derivatives volume exploded, with particularly strong performance from futures based on Chinese and Indian stock market indices. But the exchange isn’t sticking with same recipe. Under its new CEO, Loh Boon Chye, the exchange is looking for ways to continue its growth by expanding the range of products, moving into new asset classes and improving the quality of the services it delivers.

Loh, who joined the exchange in July, knows his way around capital markets in Asia. From 1995 to 2012, he worked in Deutsche Bank’s offices in Singapore and ran its global markets business in Asia. In December 2012 he moved to Bank of America Merrill Lynch, where he was head of global markets for Asia-Pacific. Loh also knows the exchange very well, having served on its board for almost 10 years.

In his public comments since taking office in July, he has talked about striving for excellence in all of the services that SGX provides to its customers. In derivatives, he is particularly focused on foreign exchange futures. SGX is well positioned to leverage Singapore’s position as Asia’s largest trading hub for FX, and building out a pan-Asian suite of currency futures would nicely complement its set of equity index futures and options.

Loh also has his eye on the fixed income market. In December, SGX launched a platform for trading Asian bonds. The strategy here is to provide investors with a solution to the fragmented state of the secondary market for Asian bonds and the challenges of finding sufficient liquidity for large trades. And if all goes well, that would lay the foundation for developing fixed income indices.

Equally important, Loh has re-organized the exchange, breaking down the walls between sales functions and product specialists and flattening the management structure. Loh says the goal is to push his company towards a more “solution-driven and customer-centric approach” to the investing, risk management and fund-raising needs of its customers. In other words, expect the exchange to make customer service its competitive advantage.

Paul Hamill

Liquidity Provider

IN THE INTEREST rate swaps market, 2015 stands out as the year when a non-bank broke into swap dealing business. Citadel Securities, the automated market-making arm of Citadel, began providing quotes on U.S. dollar interest rate swaps to asset managers and other customers, and quickly emerged as one of the top dealers by volume on dealer-to-customer platforms such as Bloomberg.

2016 promises to be more of the same. Under the leadership of Paul Hamill, the global head of FICC institutional solutions, the firm is targeting the Euro-denominated swap business, setting up shop in London and gearing up to compete for customers. The firm also is targeting the U.S. Treasury market. It’s already one of the top 10 in the interdealer market, and in late 2015 it began quoting prices to customers on Bloomberg. Also coming this year is market-making in credit default swaps, another market where there is a strong demand for new liquidity providers. And it isn’t just trading. In October, Citadel became the first non-bank clearing member of SwapClear, LCH.Clearnet’s service for interest rate swaps.

Hamill is spearheading the drive, articulating the vision in meetings with customers and interviews with the press. Many of the elements of the business were already in place when Hamill joined in 2015, but he adds to Citadel a keen understanding of electronic market- making in fixed income and credit. Before joining Citadel he worked at UBS, where he helped build the bank’s electronic trading platform for credit default swaps, one of the first to allow customers to trade with other customers. In 2014 he was named global head of execution services for FX, rates and credit, a role that included e-trading for corporate bonds as well as client SEF trading and connectivity via UBS Neo.

Hamill’s move from UBS to Citadel reflects a larger shift in the fixed income marketplace. Changes in the regulatory environment and the increased cost of capital are reducing the ability of banks to absorb risk on behalf of their customers. Equally important, the nature of market making has changed. The skill set is now far more quantitative, and the speed necessary for connectivity with market centers requires cutting edge technology. That’s the type of business where Citadel excels, and has excelled, for years in the highly automated and intensely competitive world of equities, options, futures and other exchange-traded products.

Doug Cifu

A Fierce Competitor

HARD WORK, ATTENTION to detail, team culture and constant adjustment to changing conditions. Those are the attributes of a winning ice hockey team—and a successful market-making business. No one knows that better than Doug Cifu, the chief executive officer of Virtu Financial and one of the two principal owners of the Florida Panthers. The New York-based firm, which Cifu co-founded in 2008 with former New York Mercantile Exchange chairman Vinnie Viola, is one of the top market makers in the world. With just 150 employees, the company trades more than 11,000 securities in more than 225 trading venues and liquidity pools in 35 countries.

Key to its success is its commitment to technology. Virtu has built its own technology platform that incorporates market data and evaluates risk exposures on a real time basis so that the firm can provide a continuous stream of quotes that can be updated many times per second. Virtu certainly has some of the fastest technology around, but Cifu is at pains to explain that its success doesn’t come from being faster than everyone else, it’s based on manufacturing liquidity at a lower cost.

In 2014 Virtu took a beating in the press for being associated with high-frequency trading and had to postpone its initial public offering for a year. But Cifu hasn’t backed down and he has been very open about the company’s strategy. Virtu makes a virtue out of transparency, registering with regulators, signing up with exchanges for obligations to provide continuous quotes, and revealing its financials as a public company.

Looking ahead, Cifu will have to navigate regulatory challenges in Europe and the U.S. to control the risks of automated trading. But Cifu says Virtu doesn’t oppose more regulation of automated trading. In fact he welcomes it as a “tailwind” for Virtu because it will force competitors to meet higher standards that his firm already lives by. Cifu also faces big challenges in meeting investor expectations for growth. To do that he plans to extend the business model deeper into Europe and Asia and take advantage of trends towards greater use of electronic trading and central clearing.

And somehow he will have to find time for his passion for hockey. When he and Viola bought the team in 2013, the Panthers had one of the worst records in the league and a dismal attendance record. But the new owners have since turned the team around. At the end of 2015 the team had risen to the top of the Eastern Conference and fifth in the league. If Cifu can continue the winning ways, expect playoff hockey in south Florida.

Antonio Weiss

Eye of the Storm

2015 WAS THE year when U.S. regulators finally woke up to 10 years of dramatic change in the structure of the Treasury market. Electronic trading has transformed how Treasuries trade, non-bank market-makers dominate the inter-dealer market, and large chunks of the market are invisible to regulators because banks are internalizing as much customer flow as they can.

All of this came to light after an episode of extreme volatility in U.S. Treasuries in October 2014. The whiplash in prices, which affected Treasury futures as well as cash Treasuries, had no obvious macro-economic cause, and regulators decided it was high time to take a deeper look. The Federal Reserve, the Treasury Department, the Securities and Exchange Commission and the Commodity Futures Trading Commission formed a joint task force to study the market, analyze changes in the supply of liquidity, and determine what steps need to be taken to preserve the position of the U.S. Treasury market as the deepest and most liquid securities market in the world.

The Treasury Department naturally played a leading role in this project, and the key man at Treasury has been Antonio Weiss, an investment banker who worked at Lazard Freres from 1994 to 2014. Weiss’s official title is just “senior advisor” but his understanding of how markets work has had an important influence on the U.S. government’s response to market malfunctions. Weiss was originally slated to serve as the Treasury undersecretary for domestic finance, the third-ranking official under Treasury Secretary Jacob Lew. His nomination was shot down by Senator Elizabeth Warren, however, who objected to the fact that he came from Wall Street. Since then he has served as a behind-the-scenes advisor on a host of financial markets and debt management issues.

While some officials have responded to the turmoil in the Treasury market by expressing alarm at the shrinking role of banks or by calling out for new restrictions on traders, Weiss has guided policy towards data and analysis. In a series of speeches last fall, he emphasized the need to fully understand the evolution of market structure so that the rules of the road "reflect the path ahead, not the world in the rearview mirror." He also has talked about the need to draw on "the broadest possible range of perspectives" to identify what needs to be improved and how those reforms might be made.

So what should market participants expect in the months ahead? One focus will be on the increased use of automated trading technologies. Weiss has raised concerns about the potential for increased operational risk, and has suggested drawing on the private sector’s best practices for managing risk as well as lessons learned from other markets. Another focus will be on data. Look for regulators to start a dialogue on how to improve the transparency of Treasury market trading, perhaps by building on the systems used in the corporate bond market.

Marcus Ferber

MiFID Maker

EUROPEAN MARKETS FACE another year of regulatory uncertainty. The European Commission, the European Parliament and Council of the European Union are discussing delaying 2018 the application date for MiFID II, the sweeping overhaul of market regulation. The idea is to give regulators more time to finalize the rules and for market participants to prepare for implementation.

That makes Markus Ferber a key man to watch this year. He is a member of the center-right Christian Democratic party from the Bavarian region of Germany and sits on the Economic and Monetary Affairs Committee in the European Parliament. More importantly, he is Parliament’s “rapporteur”for MiFID II. He had a central role in the drafting of the legislation in 2012 and 2013 and continues to carefully monitor the work of the European Securities and Markets Authority as it implements the new regulatory framework.

In November, ESMA asked Parliament to approve a one-year delay in the implementation date. Speaking on behalf of the members involved in the negotiations, Ferber agreed to the delay, but criticized ESMA for failing to meet the deadline and demanded that ESMA to spell out a “road map” explaining exactly what work remains to be done on the regulatory technical standards needed to implement MiFID II. He also put ESMA on notice that Parliament is not satisfied with ESMA’s rulemaking in several areas, including limits on speculative positions, market transparency requirements, and the so-called “ancillary activities” definition that affects the regulation of commodity trading by non-banks. As ESMA moves forward on the rulemaking process, expect the members of the Econ committee and Ferber in particular, to monitor the progress very carefully and to challenge any outcomes that they find unacceptable.

Ferber also is a man to watch for another reason. This year the European Commission is expected to propose legislation that will shift the funding of ESMA and two other European supervisory agencies from the public sector to the financial services industry. Ferber has been named the rapporteur for this legislation. This will give him considerable influence on this issue, and indeed all matters relating to financial market supervision.

Lynn Martin

Data in Motion

FOR MARKET OPERATORS like Intercontinental Exchange, data is the new black.

They have realized that while transaction fees ebb and flow with market volume, selling market data and related services generates revenues through thick and thin. And more importantly, the prospects for growth are often more attractive than attempting to build or buy new markets.

That is a key reason behind a wave of acquisitions made by ICE in recent years, concluding with the $5 billion acquisition of Interactive Data, a company based in Connecticut that sells data to more than 5,000 customers worldwide. Jeff Sprecher, ICE’s chief executive, calls IDC the “cornerstone” of a strategy to provide more data and valuation services to customers around the globe.

Doing the deal is one thing, but getting the most out of it is another. That’s where Lynn Martin comes in. In July 2015 Sprecher promoted Martin to president and chief operating officer of ICE Data Services, the unit of ICE that manages all of the exchange operator’s market data services. That includes data from its core trading and clearing functions as well as ICE Benchmark Administration, which sets the value of Libor, ICE Trade Vault, a swap data repository, SuperDerivatives, a specialist in forward pricing curves and derivatives valuations, and IDC. And it also includes the network and co-location services that ICE provides for the many exchanges within the group.

Martin joined ICE as part of an earlier acquisition. When ICE bought NYSE Euronext, Martin was running the U.S. branch of Liffe, the U.K. derivatives exchange and the crown jewel of the Euronext franchise. As the head of the U.S. branch, she oversaw the successful introduction of several new fixed income and equity index futures, and after the merger she oversaw the smooth integration of its contracts onto ICE’s technology platform. Once that was completed, she was named chief operating officer for ICE Clear U.S., the group’s clearinghouse for listed derivatives.

Martin’s management abilities plus her familiarity with technology—she has degrees in computer science and mathematical finance—make her an ideal choice to coordinate ICE’s various data and connectivity offerings and maximize their value to its customers. It will take a deft juggling act, however. The division she runs consists of quite a diverse set of businesses, and it will be a challenge to keep them all moving forward while simultaneously finding ways to develop new services and consolidate operations wherever possible. Equally important, shareholders want high returns from the money that ICE has invested in these acquisitions, but customers will push back if the company raises prices too quickly. That’s where Martin’s long experience in business development across technology, trading and clearing will be particularly valuable.

Jenny Knott

Post-Trade Transformation

ONE OF THE signature deals of 2015 was ICAP’s sale of its broking business to Tullett Prebon. For ICAP, the deal is a decisive break in its history as one of the top inter-dealer brokers in the financial markets. In effect, the company is moving out of voice broking, the business on which it was founded, and concentrating instead on two other lines of business: running electronic markets such as EBS and Brokertec and providing post-trade services such as market data and transaction processing.

That makes the recent hire of Jenny Knott all the more significant. Knott joined ICAP in August as the chief executive officer of post trade risk and information services, reporting directly to ICAP CEO Michael Spencer. This line of business consists of companies like Traiana, a transaction processing company, Trioptima and Reset, both of which offer risk management services, and ICAP Information Services, which provides OTC market data. This side of ICAP may not seem as glamorous as running billion dollar markets in foreign exchange and government bonds, but judging by ICAP’s latest financials, it generates more operating profit than either the global broking business or its electronic markets division.

Knott is new to ICAP, but she brings plenty of executive-level experience and management abilities. She spent 30 years working in banking, including serving as the chief executive officer of Standard Bank International, the London arm of South Africa’s Standard Bank Group. Before that she worked at Nomura Securities as international finance director and at UBS as head of finance and product control.

The task ahead of her now is to build this collection of post trade businesses into a much bigger part of the global capital markets infrastructure. One key factor in her favor: the steep increase in capital requirements on the banking industry is generating a huge appetite for portfolio compression services offered by TriOptima that reduce the amount of derivatives risk held on balance sheets. Last fall TriOptima’s triReduce service helped CME Group conduct its first multilateral compression cycle for interest rate swaps and helped CLS conduct its first compression cycle for FX forwards and swaps.

Perhaps the most interesting part of Knott’s portfolio is Euclid Opportunities, a company within a company that is tasked with investing in emerging financial technology firms that have the potential to become “next-generation providers” of post-trade services. Through Euclid ICAP has made minority investments in five companies: Abide Financial, AcadiaSoft, Duco, Enso Financial and Open-Gamma. Look for more investments of this type as Knott continues building out this rapidly growing division of ICAP.

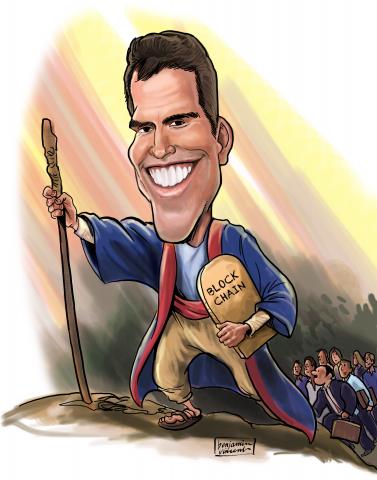

David Rutter

Promised Land

DAVID RUTTER HAS a plan to bring blockchain to banking.

As the founder and managing partner of R3CEV, a New York-based start-up, he has persuaded leading banks from Europe, North America and Asia to join forces and explore potential uses for blockchain, the distributed ledger technology commonly associated with bitcoin.

The project was unveiled in September with financial backing from nine large investment banks, including Credit Suisse, Goldman Sachs and J.P. Morgan. Other banks quickly came on board, and by the end of the year a whopping 42 banks had signed up as supporters.

Blockchain is essentially a record or ledger of digital events shared among parties in a transaction. R3CEV’s project is still at an early stage of development, but Rutter, a 30-year veteran of electronic markets, thinks the blockchain technology has the potential for tremendous improvements in operational efficiency.

Rutter’s vision is that rather than trying to develop a specific application, R3CEV will develop an open-source “base communication layer” to support blockchain applications. In other words, think of common standards on which other companies including technology vendors and the banks themselves—can build their own applications. It won’t be easy to manage all the conflicting interests within the consortium, but Rutter and his team think it’s the best approach to achieving mass adoption across the banking industry.

Financial markets are one obvious area where blockchain could be put to work. Exchange operators like CME Group and Deutsche Boerse are exploring how this technology can be used in the clearing, settlement and reporting of trades. For example, blockchain could be used to cut trade settlement times from days to minutes and drastically reduce the amount of time it takes to reconcile trading records.

Rutter’s many years of experience in electronic brokerage give him unique insights into the financial industry’s potential use of this new technology. After graduating from Villanova University in 1984, he went to work at Prebon Yamane, where among other things he co-chaired a joint venture with the Chicago Board of Trade. He joined ICAP in 2003 and played a key role in the company’s move into electronic broking, putting him into direct contact with many of the banks that are now backing his new project.

Having lived through the long transition to electronic trading in the fixed income and foreign exchange markets, he has a keen understanding of the “pain points” in market infrastructure and the potential value that distributed ledgers could provide. In the months and years ahead Rutter will have to keep his many backers working together on the journey to the promised land of blockchain.