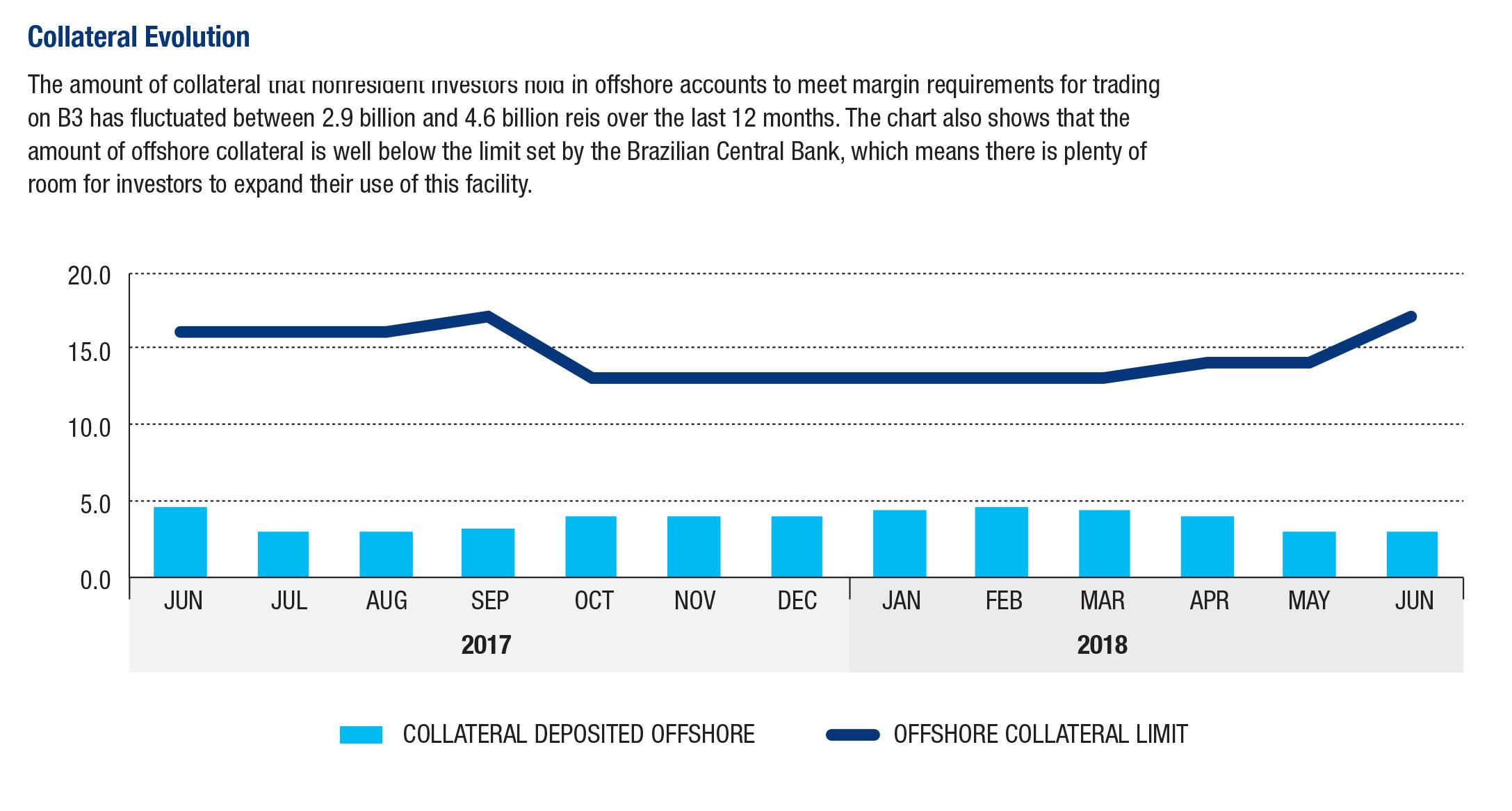

As part of its efforts to encourage more foreign participation in Brazil’s derivatives markets, the Brazilian central bank allows certain foreign entities to use collateral held in offshore accounts to meet their margin requirements at B3. This program recently was expanded to cover all of B3’s derivatives contracts, and as of June 2018, foreign investors were holding the equivalent of 3 billion Brazilian reis in offshore collateral.

The CMN Resolution #4569 authorizes nonresident investors (#4373 resolution of the Central Bank of Brazil) to post collateral abroad for the transactions in the Brazilian financial and capital markets carried out within the scope of the clearinghouses and clearing and settlement service providers authorized by the Central Bank of Brazil (BCB).

Since August 2017, B3 has been authorized by local regulators to accept assets held offshore as part of its total required collateral. This applies to all products traded at B3’s platform. The previous model for offshore collateral had been restricted to specific listed contracts, thus this recent authorization has represented a significant turning point in terms of risk and operational management for international investors, particularly due to the potential interest of newcomers entering the Brazilian market.

Posting collateral abroad is available for trades in BM&FBOVESPA segment. Nonresident investors can post collateral abroad in B3’s accounts with DTCC (The Depository Trust & Clearing Corporation), Euroclear and Citibank.

The following assets are accepted as collateral posted abroad (only for nonresident investors that comply with the criteria established in Clearinghouse Risk Management Manual):

- U.S. dollars (Citibank only)

- U.S. Treasury bills, bonds or notes

- ADRs representing stocks eligible to be accepted as collateral

- Sovereign debt of Germany (Euroclear only)

There are several conditions on the use of offshore collateral, however. First, this authorization only applies to the initial margin, and the variation margin must be paid in Brazil.

Second, there is an industry-wide limit in place regarding the usage of offshore collateral. Currently, according to in circular #3838, BCB established that, given the haircuts associated with market prices, the total amount of assets held abroad to meet domestic collateral requirements cannot exceed 8% of the aggregate margin value required by the relevant clearing and settlement system.

The total required margin and the offshore portion collected by the clearinghouse are disclosed to the public on a daily basis. This ensures that final investors are able to calculate their notional limits and also to measure consumption by the whole industry. To comply with the BCB regulation, B3 established a quarterly process of granting the limits to end clients, ensuring that the limit will not be surpassed.

Third, not all foreign jurisdictions are eligible for the use of offshore collateral. Currently, nonresident investors domiciled in the United States, United Kingdom, France and Netherlands can take advantage of this policy to meet their initial margin requirements.

Nonresident investors who intend to post collateral abroad must send their supplementary registration information, through their Brazilian broker, to B3’s Participant Registration Center. The investors who have been duly registered may submit an application to B3, through the relevant broker, for limit reservation for the posting of collateral abroad.

In compliance with Circular #3838, the Circular Letter 011/2017-DO, establishes the operation for posting collateral abroad in favor of the clearinghouse by nonresident investors.

Therefore, if an investor is eligible for offshore collateral, there is a quarterly process by which the total limit is allocated. This also will take into account the interest of the investors, according to their individual application for offshore collateral with B3. Following this, B3’s Clearinghouse will grant the limits having evaluated the following factors:

- the restriction imposed by the global limit,

- the liquidity resources deriving from the clearinghouse liquidity risk mitigation mechanisms,

- the requests submitted by non-resident investors to reserve individual limits,

- the historical margin required from the NRIs, and

- other criteria defined by B3 aimed at promoting the liquidity of certain products and facilitating the entry of new NRIs into the domestic market.

To facilitate the allocation of these limits, the investors eligible for requesting collateral offshore are split into four categories: Investors trading under 2687 accounts, Fostering liquidity providers, Investors with small limits and Recurring use.

CMN Resolution #2687 authorizes nonresident investors that only trade agricultural commodities. Customers trading under 2687 accounts settle in U.S. dollars their transactions carried out in B3 agricultural markets and post U.S. Treasuries and U.S. dollars as collateral for their transactions.

As a central counterparty for the derivatives market, the B3 clearinghouse requires collateral to be pledged by its participants as a mean to protect itself from the risk associated with their transactions. Should a participant default, the clearinghouse will be responsible for the settlement of its trades, however, it can use the participant’s pledged collateral to compensate for any such losses that may occur. Collateral margin is defined by the risk for the closeout of a portfolio faced by the clearinghouse. In order to calculate the risk for the closeout of a portfolio consisting of positions and collateral from several markets and asset classes, B3 developed an innovative risk measure: Close-Out Risk Evaluation (CORE).